This claim, of course, no longer deceives anyone while the coronavirus has left tens of thousands of casualties, as well as a large number of patients suffering from a lack of medical facilities. In the past 41 years, the Iranian people have grasped that there are much-hidden truths that counter such claims.

Particularly, Iranian citizens frequently experienced how many cases of embezzlements, rent-seeking, plundering, looting, forgeries, corruption, and secrecies there are.

In this context, the coronavirus and its economic results have emerged in the recession in the most powerful stock exchanges like New York, London, and Tokyo. However, there are several stock markets that have actually passed Iran’s bourse. They are not in the United States, Britain, and Frankfurt, but Caracas (Venezuela) and Harare (Zimbabwe).

Of course, citizens of the above two countries pursue to maintain their purchasing power by preserving their assets in the stock market. Certainly, stockholders see their countries had unprecedentedly been mired in poverty, inflation, and unemployment.

However, the Iranian clerical regime significantly seizes the advantage of this status quo to cover its tremendous budget deficit. In this respect, the mullahs spend the people’s assets on the stock market on costly foreign policies and suppression such as the salaries of their proxies in the Middle East, propaganda apparatuses, and the Islamic Revolutionary Guard Corps (IRGC).

Venezuelan Stock Market Growth of 5,500 Units in 2019

On March 6, the Tejarat News daily pointed to several reasons for the record-breaking high of the Venezuelan Stock Market. It explained that for years, the country struggles with hyperinflation, which led to dramatic growth by about 5,521 percent in 2019.

“In recent years, Venezuela has been grappling with inflation. According to the latest ranking of the misery index, the country has been ranked first on the list for the fifth year in a row,” the Tejarat News wrote.

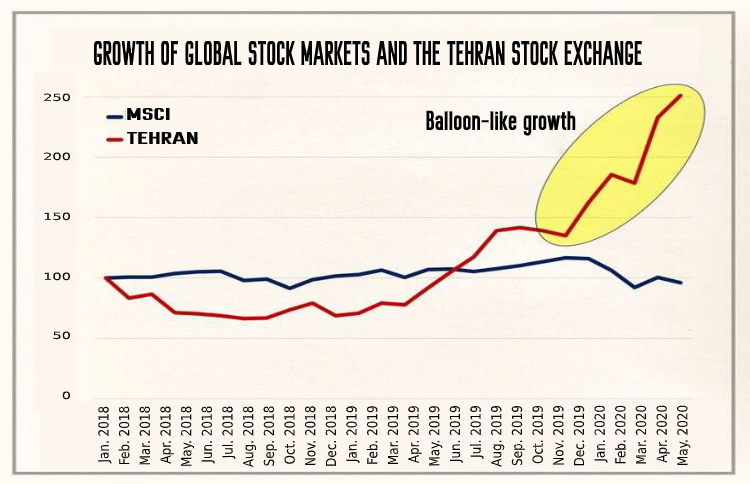

DIAGRAM

The daily also declared that Venezuelan companies have no activity in current circumstances. Also, the country witnesses a peculiar growth in the stock market due to the flowing liquidity of small businesses as well as personal capital to the stock market, the Tejarat News added.

On the other hand, the Tehran stock market gain of a 195-percent growth despite the country scrambling with the economic pressures and all indicators shows that the Iranian economy has been weakened. Notably, the ascending trend is more due to the increase in inflationary expectations and nominal growth of prices in this market, rather than the profitability of companies and the improvement of their production and sales.

Zimbabwe Stock Market

“It is interesting to know that Zimbabwe also has a stock market; a stock market with 62 companies and multi-thousands-percent growth. The Zimbabwean stock market benefits from inflation like its Venezuelan style… Its stock market represents the unbridled inflation that people have rushed to maintain the value of assets,” the Bourse 24 website wrote on April 21.

What Is the Real Reason for the Growth of Iran Stock Market?

The Iranian regime touts the current condition of the stock market as an indicator of an economic boom. However, rulers are covering up the truth about mind-blowing inflation and the devaluation of the national currency.

In this respect, on May 7, the Javan Online website rejected President Hassan Rouhani’s remarks, writing, “Mr. President, the growth of the stock market is due to inflation and the devaluation of the national currency, not the boom in production.”

In response to Rouhani’s claim about citizens’ optimism about production, the Javan Online added, “The Venezuelan stock market index has risen 200,000 percent if Iran’s stock market index rises 300 percent… Economic events over the past year are inconsistent with Rouhani’s view.”

Between 2013 and 2017, given the easy access of the regime to oil dollars and high oil prices, Iran’s rulers were able to oversee the foreign exchange market. However, in 2018, this market fell in odd turmoil, and the price of the currency suddenly reached by a factor of five. Notably, the regime’s wrong steps in the foreign exchange market were the main reasons for the mentioned economic catastrophe.

At present, the price of foreign currency in Iran has more than tripled since the spring of 2018, which led to inflation of more than 50 percent in the Iranian economy in the next months. Therefore, the stock price also inflated due to the increase in the price of factory products.

“If the stock market index alone were a sign of a healthy economy in the country, Venezuela could now become a model for all countries by setting staller records in the growth of the stock market index. However, stats of the country’s stock market show that the price of the index is daily increasing by hundreds of percent. Does it prove an improvement in the Venezuelan economy? Contrary to reach people in Venezuela who gain more wealth every day, the rest of society has severe problems in obtaining basic supplies like bread, food, and clothing,” the Javan Online wrote.

Read More:

Iran Regime Loots From Workers During Coronavirus Crisis

Balloon Growth of Iran Stock Market

In the turbulent conditions of the world economy, the influx of liquidity into the stock market of three countries with the highest inflation rates show a ballooning growth alone. The Tehran Stock Market started the new year with less than 500,000 units and reached 700,000 units in the middle of April. Now, the number of units has surpassed one million.

This event is taking place while the U.S. stock market along with European and Asian stock exchanges is still in decline. Experts say the growth is balloon-like and it is likely to fall in the coming months.

On the other hand, the production cycle of the country has been stopped. In this respect, the regime-linked analyst centers predict that Iran’s budget deficit is the likelihood to exceed between $7-9 billion. This matter shows that the funds in the stock market have not moved towards the production field and employment. Instead, this asset has formed a dangerous bubble in the country’s economy.

Additionally, an economic expert Mahmoud Jamsaz exposed a part of the regime’s misleading society. “The government has tried to gain funds by offering shares in state-owned companies. However, the valuation of these companies is not accurate. For example, a company whose real value was only $1.2 million, sold for $228 million, or the shares of a company that had no activity and were completely closed, suddenly increase from 0.3 cents to 30 cents,” The Shahrvand quoted Jamsaz as saying on May 4.

In this respect, most economic analysts believe that the growth of the stock market is due to the inflow of stray liquidity into the market. Therefore, the stock market era is over when the major shareholders decided to cash their stocks. In this condition, ordinary people and small businesses will fall victim to the balloon-like valuation and the liquidity will return to the gold and currency markets.

These truths prove that an economic crisis is waiting for Iranian families who now are struggling with the coronavirus and its ominous impacts in economic affairs. On the other hand, the regime’s horrible policies in leaving the people without tangible support and rebounding them to workplaces have merely led the society to misery.

The ayatollahs leave the people to opt between dying of the coronavirus or starvation despite their multi-billion assets and financial institutions. This circumstance may trigger public ire against the rulers in the coming months. This is a certain fate, which has prompted severe concerns among Iranian authorities.

Read More:

Iran’s Regime Sacrifices People’s Lives Amid Coronavirus Outbreak